The following is a question submitted by a reader to Federal Times columnist Reg Jones, a charter member of the senior executive service and the resident expert on federal employee retirement issues.

A Fed Times reader asks:

“My wife is covered on my “self+1″ Blue Cross FEHB plan. She will turn 65 this summer and will be going on Medicare Parts A and B. I am still 62 and will need to remain on the FEHB plan.

Is there some way I can change my FEHB enrollment to a “self only” plan at that time, or will I have to wait until open season in the fall?

Do I need to suspend her coverage as a spouse of an annuitant in order to preserve her ability to return to an FEHB plan if her new gap insurance doesn’t work for her needs?”

Reg’s response:

There is no provision in law or regulation that would allow you to suspend your wife’s FEHB coverage.

You could, of course switch to Self Only coverage; however, if you were to die before you were able to switch back, your wife would only be covered by Medicare A and B.

Got a question for the Federal Times expert? Send inquiries to: fedexperts@federaltimes.com.

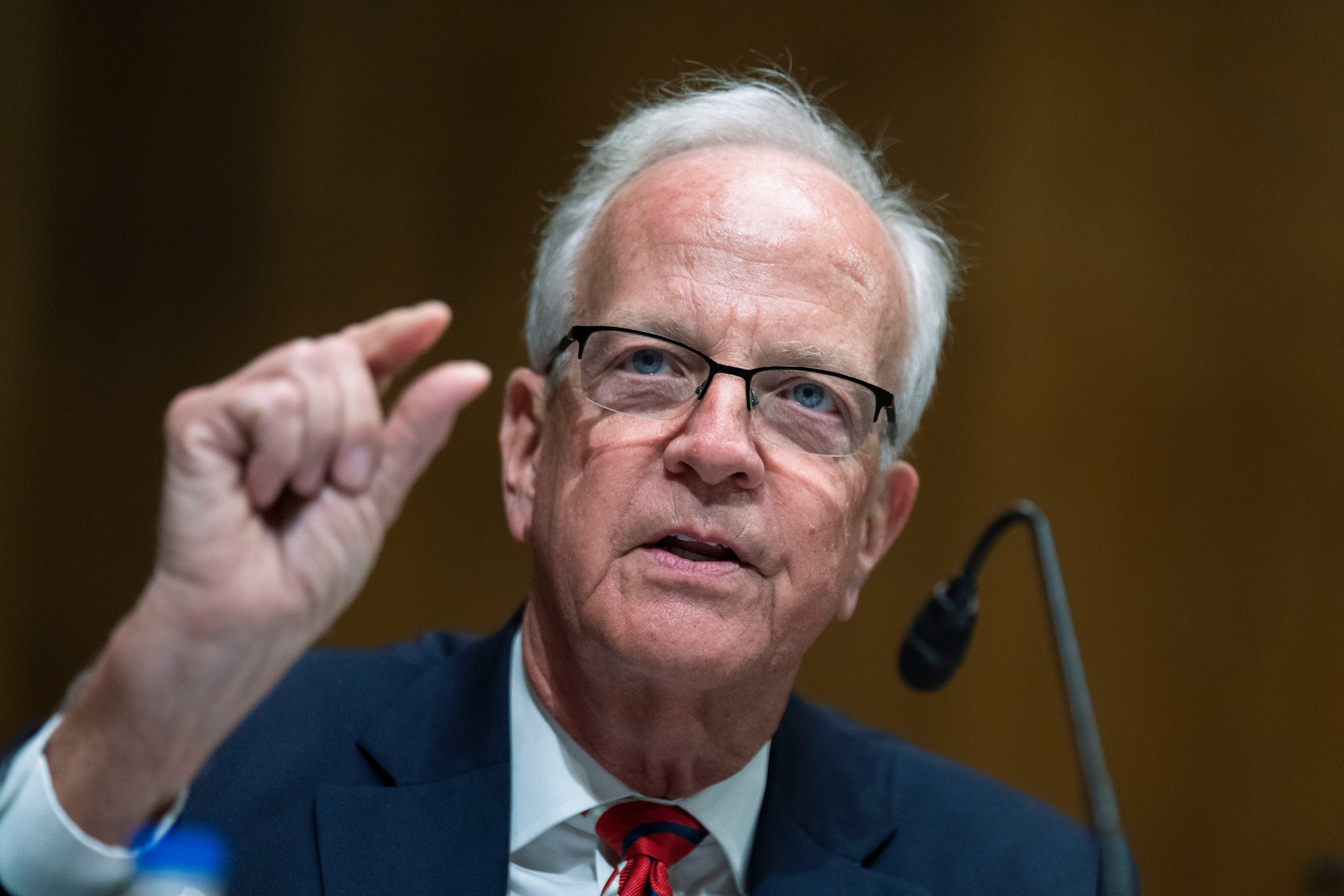

Reg Jones, a charter member of the senior executive service, is our resident expert on retirement and the federal government. From 1979 to '95, he served as an assistant director of the Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.