“I am a retiree under the CSRS Offset, and retired with 32 years of federal service, 4.5 of which were as a Peace Corps volunteer. I started taking Social Security at the age of 67, but just received notification that I was subject to the Windfall Elimination Provision. In reviewing the information on the Windfall Elimination Provision, it looks like I could potentially be substantially penalized for not having substantial earnings during my Peace Corps time. Given this was all federal time, and I paid in to my Peace Corps time for my retirement, and the Social Security was offsetting my pension, this does not seem to be fair. If I’d been in CSRS, this wouldn’t be an issue. Is there a policy on this?

Reg’s Response

The windfall elimination provision applies to anyone who has earnings from wages or self employment where they didn’t pay Social Security taxes, such as CSRS, and has fewer than 30 years of substantial earnings. While the WEP won’t reduce any benefit amount attributable to federal service where Social Security taxes were withheld, such as CSRS Offset or FERS, it will affect employment where such taxes were not paid.

To see how the WEP might affect you, go to https://www.ssa.gov/pubs/EN-05-10045.pdf.

RELATED

Got a question for the Federal Times expert? Send inquiries to: fedexperts@federaltimes.com.

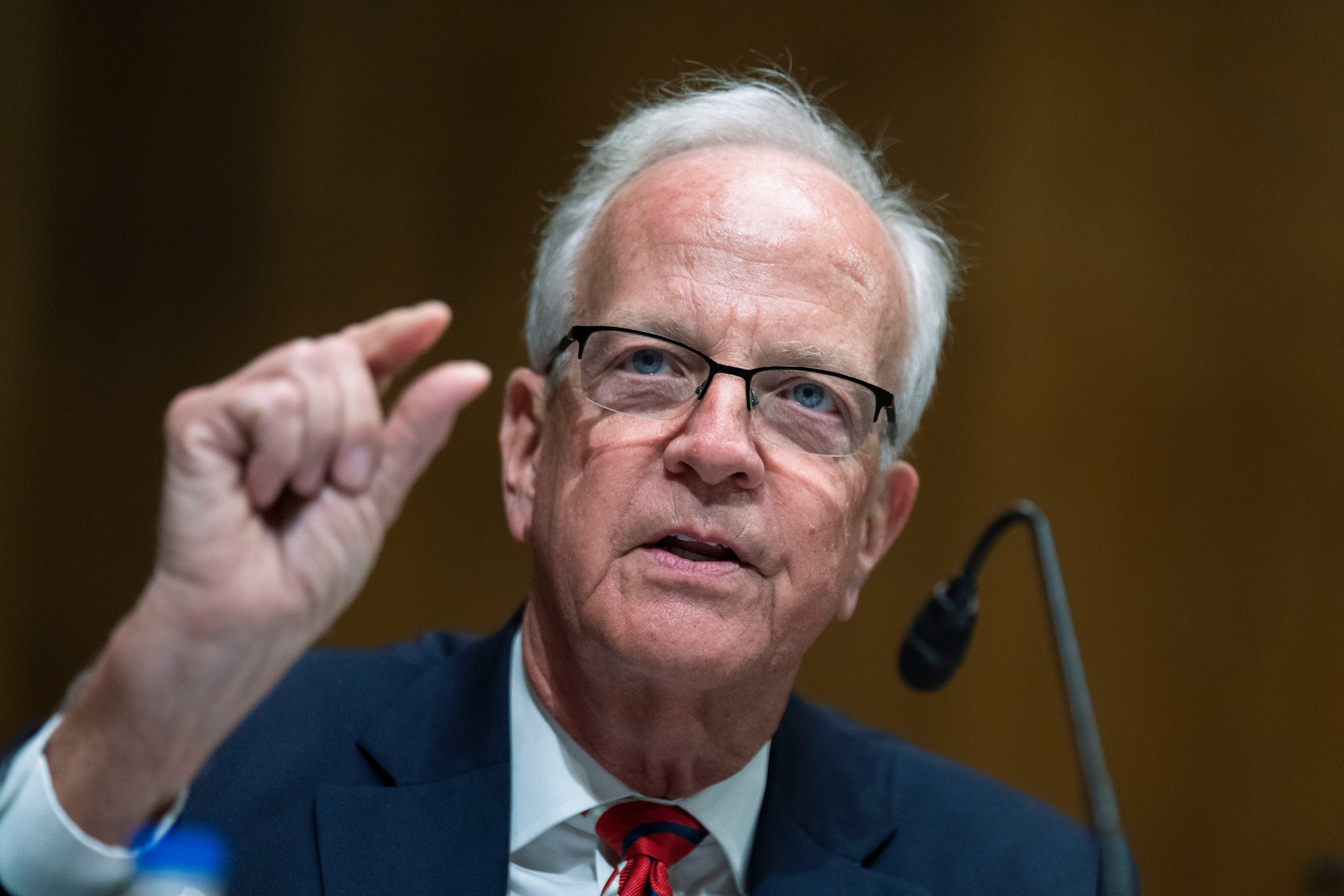

Reg Jones, a charter member of the senior executive service, is the resident expert on retirement and the federal government at Federal Times. From 1979 until 1995, he served as an assistant director of the U.S. Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.

Reg Jones, a charter member of the senior executive service, is our resident expert on retirement and the federal government. From 1979 to '95, he served as an assistant director of the Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.