“I retired from federal government in 2011. My husband passed away in 2017. I applied for his social security and was told I made too much money. My annuity is $61,000 yearly. Can I get his SS?

Reg’s Response

Because you were employed under CSRS - a retirement system where you didn’t pay Social Security taxes - some or all of the Social Security survivor benefit for which you might be qualified would be offset by the Government Pension Offset provision of law. The GPO reduces that survivor benefit by two-thirds of the amount of your CSRS annuity. Since your annuity is $61,000 a year, it’s likely that any survivor Social Security benefit to which you’d otherwise be entitled would be reduced to zero.

Got a question for the Federal Times expert? Send inquiries to: fedexperts@federaltimes.com.

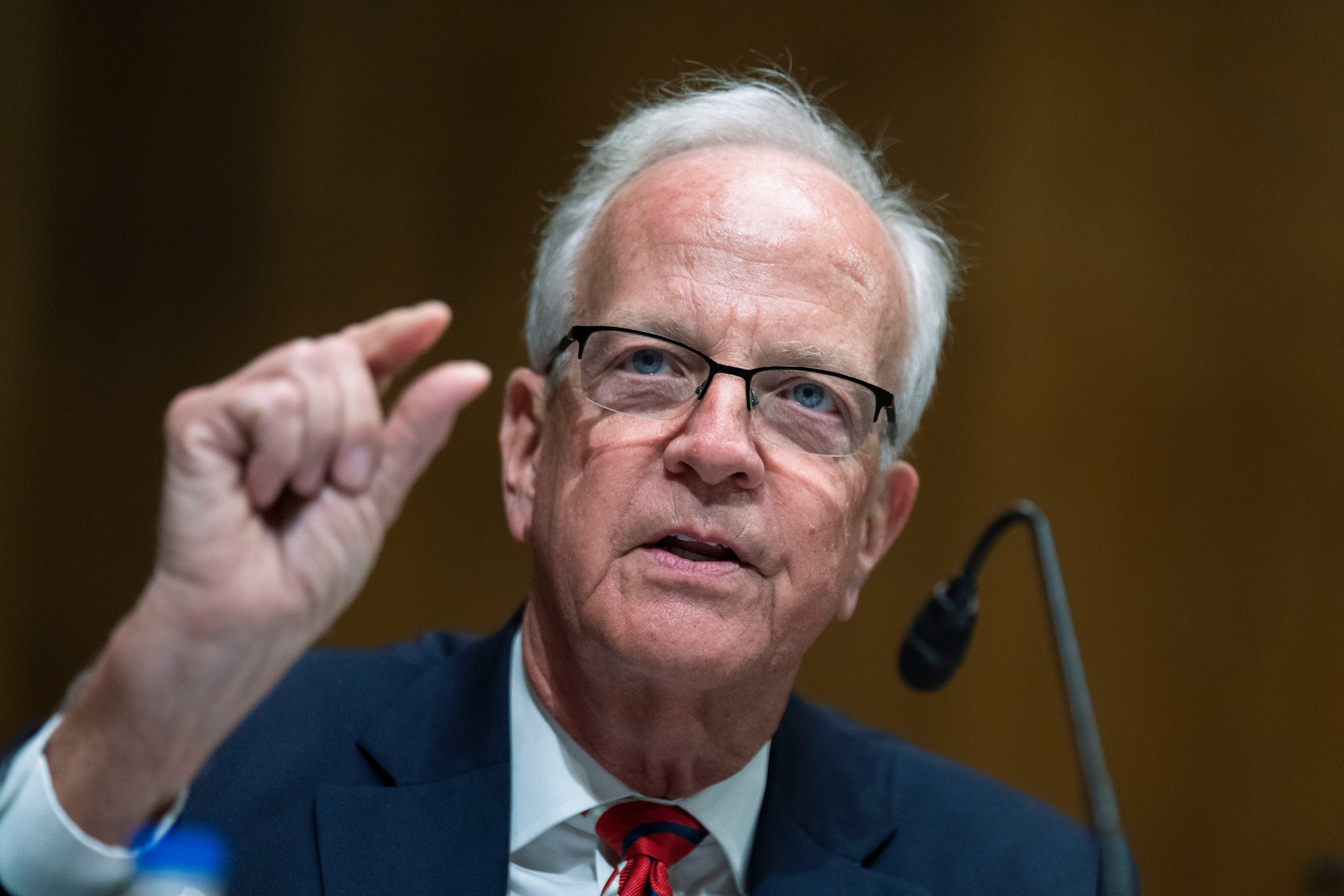

Reg Jones, a charter member of the senior executive service, is the resident expert on retirement and the federal government at Federal Times. From 1979 until 1995, he served as an assistant director of the U.S. Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.

Reg Jones, a charter member of the senior executive service, is our resident expert on retirement and the federal government. From 1979 to '95, he served as an assistant director of the Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.