Time is running out for those of you who have the right combination of age and service to retire before the new leave year begins on Jan. 6, 2019. So, what’s so important about retiring before the end of the leave year? I’ll tell you.

Annual leave

Most employees can only carry over 240 hours of annual leave from one leave year to the next. If you have more than 240 hours of “use or lose” leave, there’s a big incentive to retire before those hours are lost. That’s because you’ll receive a lump-sum payment for every hour. More importantly, those hours will be projected forward as if you were still on the job. Because there will be a pay increase in 2018, the closer you retire to the end of the 2018 leave year — January 5, 2019 — the more of those hours will be paid at the higher hourly rate.

There are two other factors to consider before you put in your retirement papers. First, if you are a FERS employee, you’ll have to retire no later than Dec. 31, 2018, to be on the annuity roll in January 2019. If you are a CSRS employee, you’ll have to retire no later than Jan. 3, 2019, to be on the annuity roll in that month. However, for every one of those three days you aren’t on the annuity roll, your annuity for that month will be reduced by one-twelfth.

Second, because you’ll be retiring at the end of the year both your agency’s personnel office and the Office of Personnel Management’s Retirement Operations Center will be flooded with applications. As a result, there will be a longer than usual delay before your agency sends your paperwork to OPM, where it will land in their overflowing in-basket. However, as soon as OPM can get to it, they will send you a partial payment each month until they can finalize your application and send you your first full annuity payment. While you’ll eventually receive all the money you are due, it could take a couple of months. So be prepared.

Taxes

If you retire at the end of a calendar year, the amount you pay in taxes for that year will be greater than they will be in the year after you retire, even if you’re paid for a lot of unused annual leave and/or receive a buyout. That’s because you’ll be receiving an annuity that is much less than your salary was. And a portion of that annuity will be tax exempt.

In closing

Consider the financial consequences of your decision, have a clear idea about why you are leaving, and make sure you know what you’ll do after you retire.

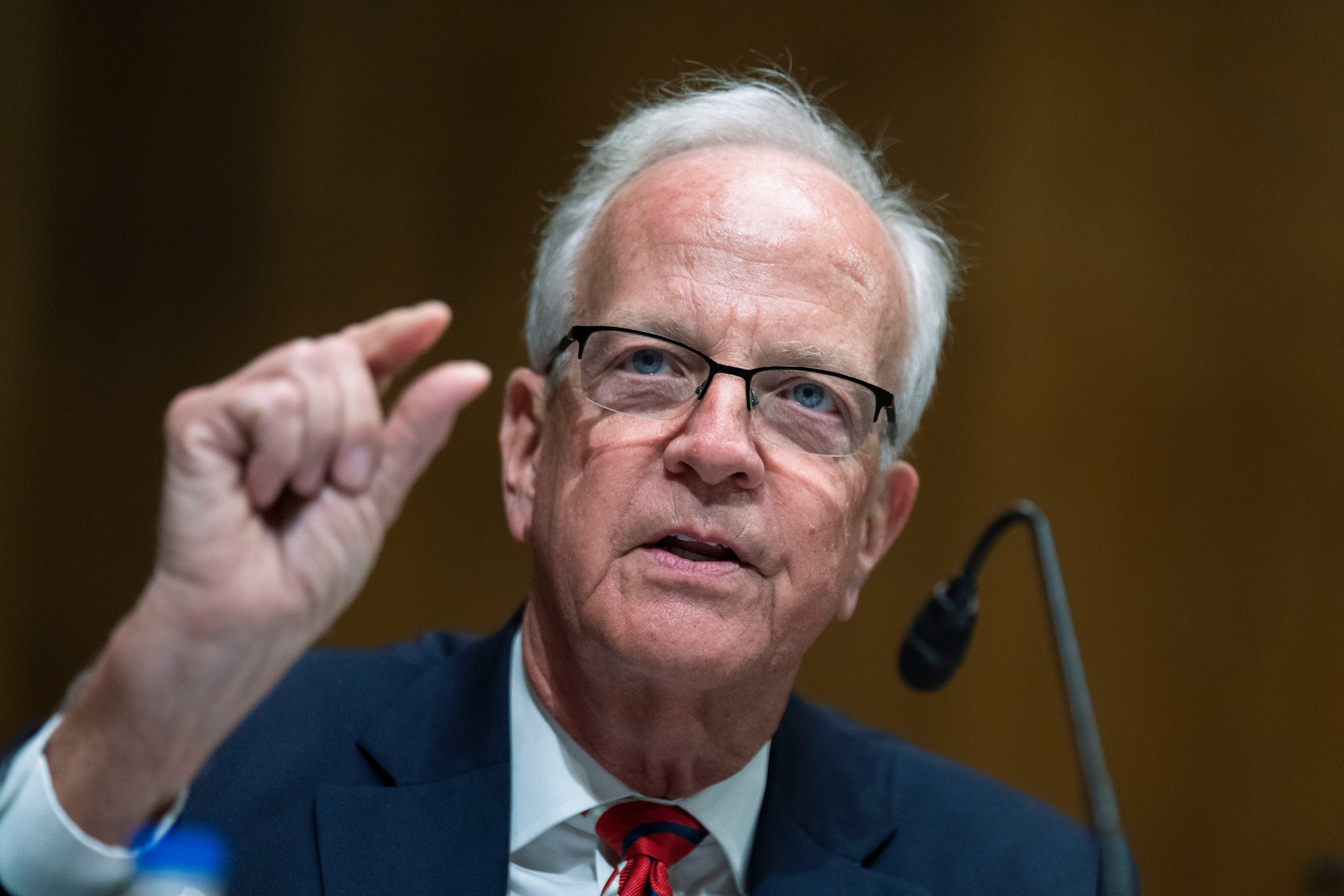

Reg Jones, a charter member of the senior executive service, is our resident expert on retirement and the federal government. From 1979 to '95, he served as an assistant director of the Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.