If you’ve been watching the ups and downs of the stock market — and the balance in your Thrift Savings Plan — during the current COVID-induced economic crisis, you may feel a bit nervous and wonder whether you should take some sort of action.

First, remember what that TSP is: it’s a long-term savings program that’s meant for saving for retirement. Before you’re tempted to try your hand at market timing, or are swayed by some fraudsters urging you to take money from your TSP right now to invest outside the TSP, step back, says Gerri Walsh, senior vice president of investor education at the Financial Industry Regulatory Authority, known as FINRA.

“It’s important in the overall scheme of things to have a long-term plan and to stick with it,” Walsh said.

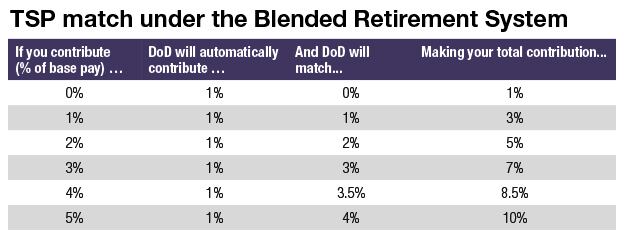

The TSP is like a private-sector 401(k) retirement plan savings account. Make sure you’re contributing as much as possible to your TSP, and if you’re in the Defense Department’s Blended Retirement System, contribute at least enough to get the 5 percent matching contribution from the military.

The TSP is a key part of the BRS because it allows service members to build up retirement savings with help from DoD and take the money with them, even if they leave before serving to full retirement age.

As of the end of 2019, 56 percent of service members in the BRS were contributing at least 5 percent of their basic pay or inactive duty pay to their TSP, said DoD spokeswoman Lisa Lawrence. That’s about 480,000 service members contributing at least 5 percent, out of nearly 860,000 BRS participants.

But that also means that about 44 percent of you, or about 380,000 service members, are leaving money on the table. “The matching contribution that’s available to service members under the TSP is invaluable. It’s basically free money,” Walsh said.

What changes should I make now?

There are a variety of investments available in the TSP.

FINRA doesn’t give advice on what changes you should or shouldn’t make in your investment mix right now, but puts more emphasis on the importance of sticking with a long term plan, Walsh says.

“A lot of people think,‘Oh, the stock market is falling. I’d better sell.’ That can often be the worst time to sell, because you’re locking in losses. Or they see that the stock market is going up, and they think, ‘Oh, I’m going to pour all my money into the stock market.’ But that might be the worst time to put all your money into the stock market because prices are high, and so you’re buying in at a high level,” Walsh said.

Thinking about the long-term plan in general, there are a number of investment options in the TSP for service members who may be thinking about investing in stocks as part of their diversified portfolio, she said. The C Fund invests in the largest U.S. companies, the S Fund invests in small- to medium-sized companies; and the I Fund invests in foreign companies.

It’s also a good idea to have some percentage of your retirement savings in the traditionally less risky investments like the bond funds and the G Fund, Walsh said. The G Fund is invested in government securities. A number of service members and federal employees use the L funds, which are lifecycle funds with target dates that allow you to choose the year closest to your anticipated retirement date, and the fund will automatically re-balance the investments quarterly to make sure you’re staying diversified. Diversified means you’re putting your money in a variety of investments to reduce risk.

In talking to service members over the years, Walsh said, one thing she has heard is that investing in an Individual Retirement Account is better than investing in the TSP. “It’s unfortunate that that message gets out, because the TSP does provide a match, and it does provide low cost, diversified selections,” she said. There are a number of other advantages, such as the ability to make contributions from tax-exempt pay, basic pay, incentive pay, special pay, and bonus pay. You can take a loan from the TSP if you encounter a financial emergency.

Beware of fraudsters in the COVID environment

A word about those loans. Because of the economic struggles people have had during the pandemic, Congress put provisions in the CARES Act to allow people take out money from a retirement plan for a COVID-related issue, with fewer penalties for early withdrawals, as well as a longer period to repay loans from retirement accounts.

But that doesn’t mean it’s a good idea to do it. Some fraudsters and other bad actors are using these CARES Act benefits to promote high-risk, high-fee investments and other inappropriate products and strategies, according to a joint advisory from FINRA, the Securities and Exchange Commission, and the North American Securities Administrators Association.

The fraudsters are encouraging people to take money out of their TSP or 401(k)s, or traditional IRAs to buy high risk investments outside their retirement plans, not for emergency financial needs. “That’s a risky move, because you’re betting that markets go up, and with the market volatility that we’ve been seeing, markets are going up and markets are going down,” Walsh said.

“You have to affirmatively put the money back into your retirement account at some point that you’ve withdrawn as a loan. You always risk, if you take your money out, that you’re either locking in a loss, or spending too much, so it can be a dangerous move.”

But if you’re experiencing financial difficulties because of COVID, and there’s no other alternative besides taking money from the retirement fund in some fashion, the new provisions in law will ease the cost of using those funds.

Here’s how the TSP works

For those new to the military, after you have served for 60 days, a TSP account will be created, and automatic deductions of 3 percent of your basic pay start going to your TSP. (You can change that amount, but by law, you will automatically be re-enrolled at 3 percent each year.) DoD kicks in 1 percent automatically, but will contribute up to an additional 4 percent of base pay to match your contributions. So if you contribute 5 percent, the DoD match brings it to 10 percent.

The DoD Financial Readiness website for service members puts that into perspective, with an example of hypothetical service members with the same hypothetical monthly salary of $2,800, contributing different percentages of their paychecks to their TSP, in the L 2050 Fund, compounded at 8 percent a year. “Aaron” contributes 1 percent of his pay, or $28; and “Bryan” contributes 5 percent, or $140. In 10 years “Aaron” would have $14,602; and “Bryan” would have $48,675.

That DoD match makes a big difference. DoD is matching “Bryan’s” 5 percent monthly investment, bringing it to 10 percent, or $280 a month.

The money you contribute to your TSP is always yours. You own the DoD contributions after you serve at least two years.

The TSP is a long-term investment, and there could be penalties for early withdrawals, although there are currently some provisions to ease the penalties for those who have to make withdrawals for current COVID-related needs. Your overall long term plan should include an emergency fund, to help you can weather a financial storm, such as a repair bill or legal issue — or to help mitigate the reduction in family income from a spouse’s job loss during a pandemic or a military move, for example.

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.