Editor’s note: This story was updated on Nov. 7 to reflect new information.

On top of worrying about getting a paycheck during a government shutdown, federal employees should also be wary of scammers trying to make money off furloughed workers.

During previous shutdowns in 2013 and 2019, banks and concerned lawmakers posted notices of attempted fraud or malicious lending by imposters who appeared to be calling from a federal agency, such as the IRS, to scare victims into providing personal information.

“Unfortunately, individuals will capitalize on federal workers’ vulnerabilities and lack of income during this time and try and take advantage of them,” said former Virginia Attorney General Mark Herring in 2019.

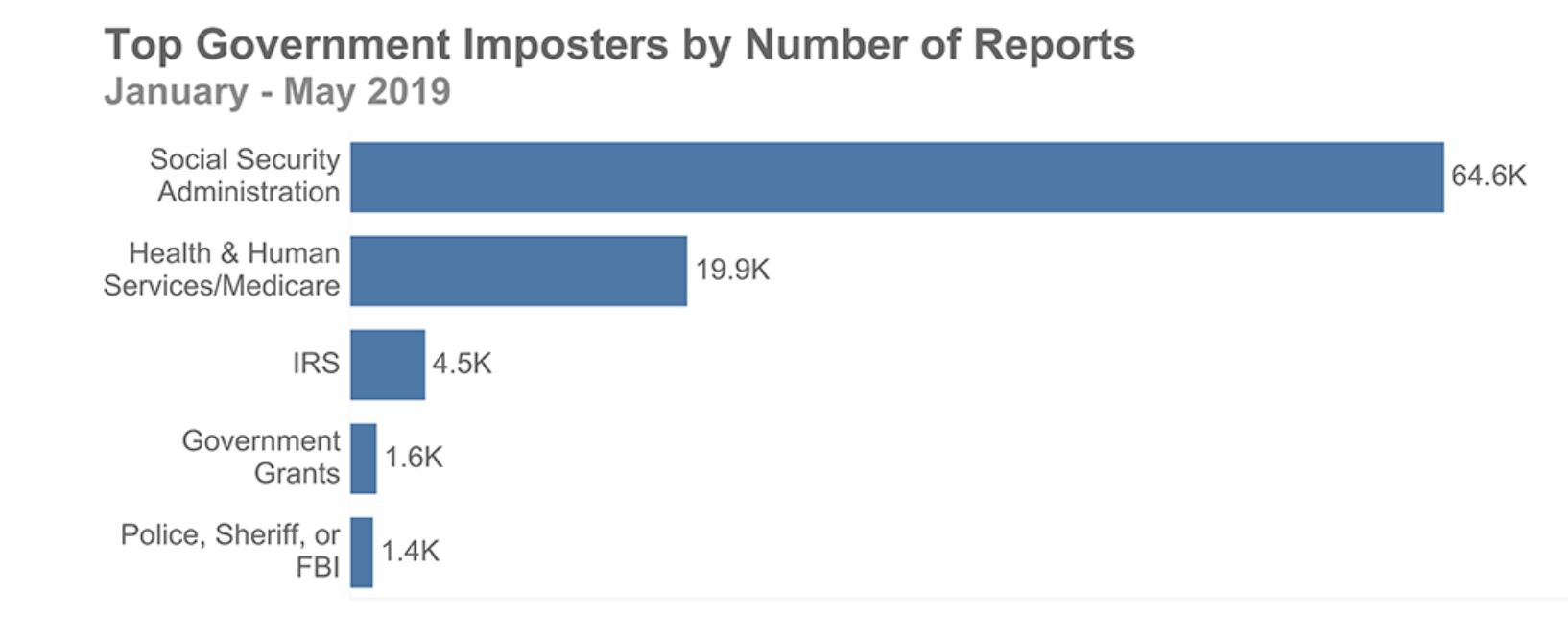

During the COVID-19 pandemic, a period of similar uncertainty and instability, the Better Business Bureau observed a spike in reports of scammers pretending to be government agents. And the most popular agency cited was the Social Security Administration, accounting for more then two-thirds of imposter scams.

The government is now less than two weeks away from the deadline to pass a budget measure before the current stopgap bill expires on Nov. 17. The House has passed seven of 12 spending bills, and the Senate has passed three. None have made it through both chambers.

Swindlers’ attempts can take different forms. Some might be robocalls. Others could be text messages, emails, internet pop-ups, flyers or door-to-door solicitations that threaten Medicaid coverage will end or a savings account will be closed if individuals don’t respond.

“Government impersonators can create a sense of urgent fear, telling you to send money right away or provide your Social Security number to avoid arrest or some other trouble,” the Federal Trade Commission said in a press release in 2019. “Or they can play the good guy, promising to help you get some free benefit like a grant or prize, or even a back brace.”

And looks can be deceiving. During a shutdown, some legitimate credit unions that are geared toward serving government employees are used to shutdowns and do offer programs to qualifying workers. Even those have eligibility requirements, so they’re not available to just anyone, and each bank will have information on their website or distributed to members.

Federal Times confirmed some of these programs by reaching out directly to various credit unions and lenders, which you can read about here.

While impersonators are a danger any time of year, the federal government’s ability to respond to timely complaints from impacted members of the public is limited during a shutdown.

RELATED

Normally, the FTC maintains the Do Not Call Registry to protect consumers from receiving unwanted commercial telemarketing calls. When the government shutdown in 2019, consumers reported not being able to access it.

In the event of a shutdown, the agency’s Bureau of Consumer Protection would have to furlough 85% of its office staff. The Consumer Response Center will suspend operations, and staff will be unavailable to respond to complaints, inquiries, or requests for information, according to the agency’s recently updated shutdown plan. Other resources, like DoNotCall.gov, ReportFraud.ftc.gov, IdentityTheft.gov, and e-consumer.gov, will also be unavailable while there is no budget deal.

The Consumer Sentinel Network will remain available to law enforcement as a “necessarily implied” function, the plan said.

The threat of a shutdown, which seems more realistic as Congress has just hours to get even a short-term deal past a blockade of House Republicans, comes two months after the FTC announced a new initiative in partnership with more than 100 federal and state law enforcement agencies to crack down on billions of illegal telemarketing calls made to the public.

Current funding levels for federal agencies expire Saturday at midnight.

Guard yourself from shutdown-related scams and phishing

- Double check any emails with a search for the company’s website to verify information.

- For part-time work advertisements, remember if it’s too good to be true, it probably isn’t. High pay for simple tasks, immediate offers with no interview, up-front payment or information requests, or obscure search results for the recruiter or company can be red flags.

- Never reply to a suspicious email or provide personal information to an unsolicited phone call asking for it, especially if they seem aggressive and pushy about it.

- Be wary of clicking on suspicious links that change one or two letters from an existing reputable website.

- Give to charities and fundraisers that you can verify.

- If you’re being offered a low-cost or no-interest loan, consider why someone would do that at a time when interest rates are at record highs. Be sure you understand the risks of payday, auto title, open-end or online loans.

- Run into something you think is suspicious or harmful? Contact:

- Virginia Attorney General’s Office of Consumer Protection

- Maryland Attorney General’s Consumer Protection Division

- District of Columbia Attorney General’s Consumer Protection Office

- Reach out to your local police department to report financial crimes.

Molly Weisner is a staff reporter for Federal Times where she covers labor, policy and contracting pertaining to the government workforce. She made previous stops at USA Today and McClatchy as a digital producer, and worked at The New York Times as a copy editor. Molly majored in journalism at the University of North Carolina at Chapel Hill.