The White House’s Office of Personnel Management urged providers of health insurance to federal workers keep gender-affirming medical care in their plans.

In the annual program letter, OPM said that executive orders direct it to “promote equitable healthcare coverage and services for enrolled LGBTQ+ employees and their covered family members” through the Federal Employee Health Benefits program, which provides more than 8 million people with coverage offered by nearly 270 plans.

Each year, OPM writes to insurers in the FEHB program detailing its policy and benefit goals and requirements for the upcoming plan year. Carriers have until the end of May to submit responses. Then the carriers and OPM negotiate the proposed benefit packages in time for open enrollment every fall.

The Biden administration has used policy directives like this to further its diversity and inclusion initiatives across agencies and programs. Republicans in Congress and state legislatures have pushed back, especially against gender-affirming care, which some have said can be a form of child abuse, while others have shown doubts about how medically safe these procedures are.

In 2021, legislatures in 22 states introduced bills to ban forms of medical care for transgender young people, according to the Movement Advancement Project, a think tank. A few states have reportedly proposed laws that would curb such care for adults, as well, according to the Washington Post.

The March 1 OPM letter to insurers makes no mention on age restrictions for care.

Gender-affirming care is defined by the Kaiser Family Foundation as a spectrum of “social, psychological, behavioral or medical interventions designed to support and affirm an individual’s gender identity.” That can include counseling and impermanent options to start, like hormone therapy. Then, surgical procedures may be considered in adulthood or for youth on a case-by-case basis.

For the upcoming plan year, OPM encourages carriers to pay specific attention to a reduction in the number of required evaluation letters for initiation of treatment, medical necessity of facial gender affirming surgery, hormone therapy and workforce cultural-awareness training.

RELATED

In January 2016, OPM required that no FEHB carrier have a general exclusion of services, drugs or supplies related to the treatment of gender dysphoria, Federal Times previously reported.

The Supreme Court also ruled in 2020 that benefit plans which deny coverage to transgender employees, charge them a higher premium or fail to provide medically necessary services are discriminatory.

OPM again nudged carriers to review clinical guidelines from health care organizations — like the World Professional Association of Transgender Health, the Endocrine Society and the Fenway Institute — to inform benefits for transgender and gender diverse patients.

Infertility coverage is a focus — again

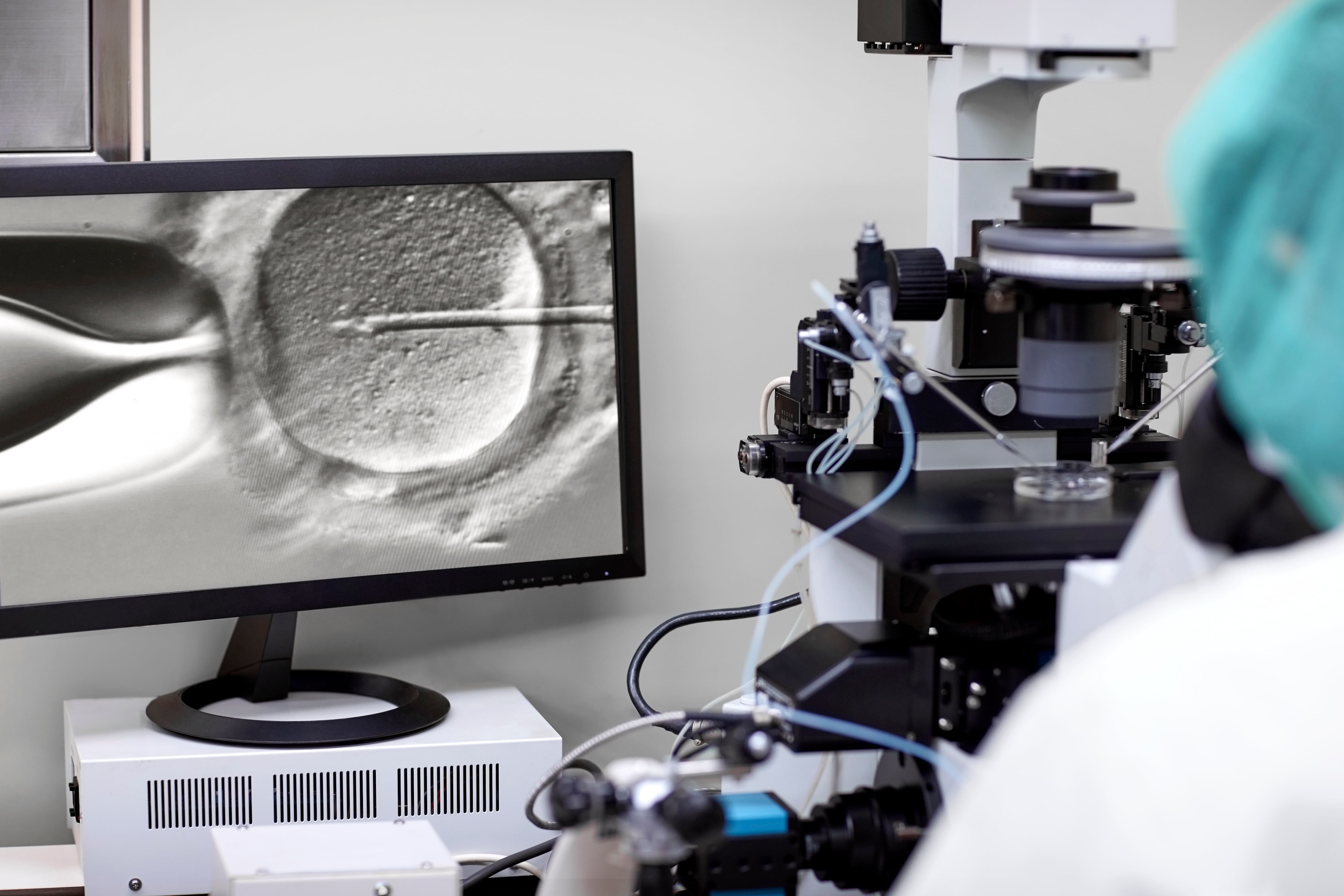

One of the sore points in years past for FEHB has been its spotty, and at times completely lacking, coverage of artificial reproductive procedures, such as in vitro fertilization.

Critics of the program have said the federal government’s insurance plans have been slower to adopt comprehensive infertility care while 20 states have passed fertility insurance coverage laws since 2022.

RELATED

OPM said in its call letter it “supports the provision of benefits that will help enrollees build their families and recognizes the valuable role ART and other fertility benefits play in recruitment and retention.”

With stronger language than was seen last year, OPM said it is now requiring carriers to cover artificial insemination, whether intrauterine, intra-cervical or intra-vaginal. This requirement to cover artificial insemination does not include donor sperm.

Carriers are also required to generally cover drugs associated with artificial insemination procedures. With regard to IVF, carriers must cover the cost of IVF-related drugs for three cycles annually.

OPM is also telling carriers to provide a definition of infertility and qualifications for these benefits in easy-to-understand language in brochures and websites because it has been unclear in the past. Applicable medical policy related to infertility coverage must also be easily findable on websites.

Medicaid Part D supplemental drug coverage

In years past, federal employees have not had to look outside of their FEHB plan for good prescription drug coverage because many federal plans were just as good or better than Medicare Part D.

Part D is optional coverage that can be obtained as a supplemental or through an FEHB Medicare Advantage plan.

Recent changes to Part D might make it a better deal for federal annuitants, thanks to the Inflation Reduction Act.

Starting this year, the law required a $35 cap on the cost of insulin products. In 2024, it will eliminate the 5% coinsurance for Part D catastrophic coverage and expand income eligibility for the low-income subsidy to 150% of the federal poverty level.

Then, in 2025, there will be a $2,000 cap on a Part D enrollee’s out-of-pocket costs and until 2030, Part D premium growth is capped at 6% per year.

Because these changes may make Part D favorable for FEHB beneficiaries, OPM is expecting insurance companies to coordinate drug coverage for FEHB annuitants and covered family members.

OPM shuts the door on copay maximizers

OPM said it will not entertain “any proposals” that include copay maximizer or optimizer programs for plan year 2024.

In a nutshell, through an accumulator program, a manufacturer can offer copay cards and coupons that cover costs of a name-brand drug, but they doesn’t count toward the deductible or out-of-pocket maximum, effectively resulting in higher costs to the patient over time.

As of 2022, 14 states have banned copay accumulators.

“Programs that eliminate or bypass the copay/coinsurance maximums negotiated as protections in the benefit design are not in the best interest of the enrollee or the federal government,” OPM said.

Priority rollovers from 2023

The Biden-Harris administration has made other commitments to ensuring FEHB carriers cover a broad range of treatments aimed at not just good physical health, but also quality of life.

This includes prevention of and medication for obesity, mental health support, treatment of substance use disorders and resources for maternal health.

RELATED

When is open season for 2024?

Federal regulations say open season will be held each year from the Monday of the second full work week in November through the Monday of the second full workweek in December.

That means for 2024, open season is slated for Nov. 13 to Dec. 11, 2023.

OPM expects to complete benefit negotiations by July 31 and rate negotiations by mid-August to ensure a timely open season.

Molly Weisner is a staff reporter for Federal Times where she covers labor, policy and contracting pertaining to the government workforce. She made previous stops at USA Today and McClatchy as a digital producer, and worked at The New York Times as a copy editor. Molly majored in journalism at the University of North Carolina at Chapel Hill.

In Other News