The following is a question submitted by a reader to Federal Times columnist Reg Jones, a charter member of the senior executive service and the resident expert on federal employee retirement issues.

A Fed Times reader asks:

“When I was working, I was paying into my Medicare biweekly. Now that I’m fully retired, say when I start applying for Medicare three months before my 65th birthday, will I get billed for this every three months? And if so will I get a reimbursement check a year later [for the amount I paid in?]

My father was working for the city back then, and he had to pay into his Medicare, but they reimbursed him with a check. Does it make a difference if he used to work for the city, and I used to work for the state?”

Reg’s response:

When you retired, you were no longer required to pay for Medicare Part A.

However, if you are receiving a Social Security benefit, you will be automatically enrolled in Medicare Part B. You will have to pay for that coverage unless you decline it.

If you aren’t receiving a Social Security benefit, you have the option to enroll in Part B during the seven-month enrollment period that begins three months before you turn age 65 and ends three months after that month.

If you decide not to enroll and later decide that you want to do that, you can sign up during any open enrollment period. Open enrollment periods begin every year on Jan. 1 and end on March 31.

Just beware that your premiums would be increased for every year you declined that coverage.

Got a question for the Federal Times retirement expert? Send inquiries to fedexperts@federaltimes.com

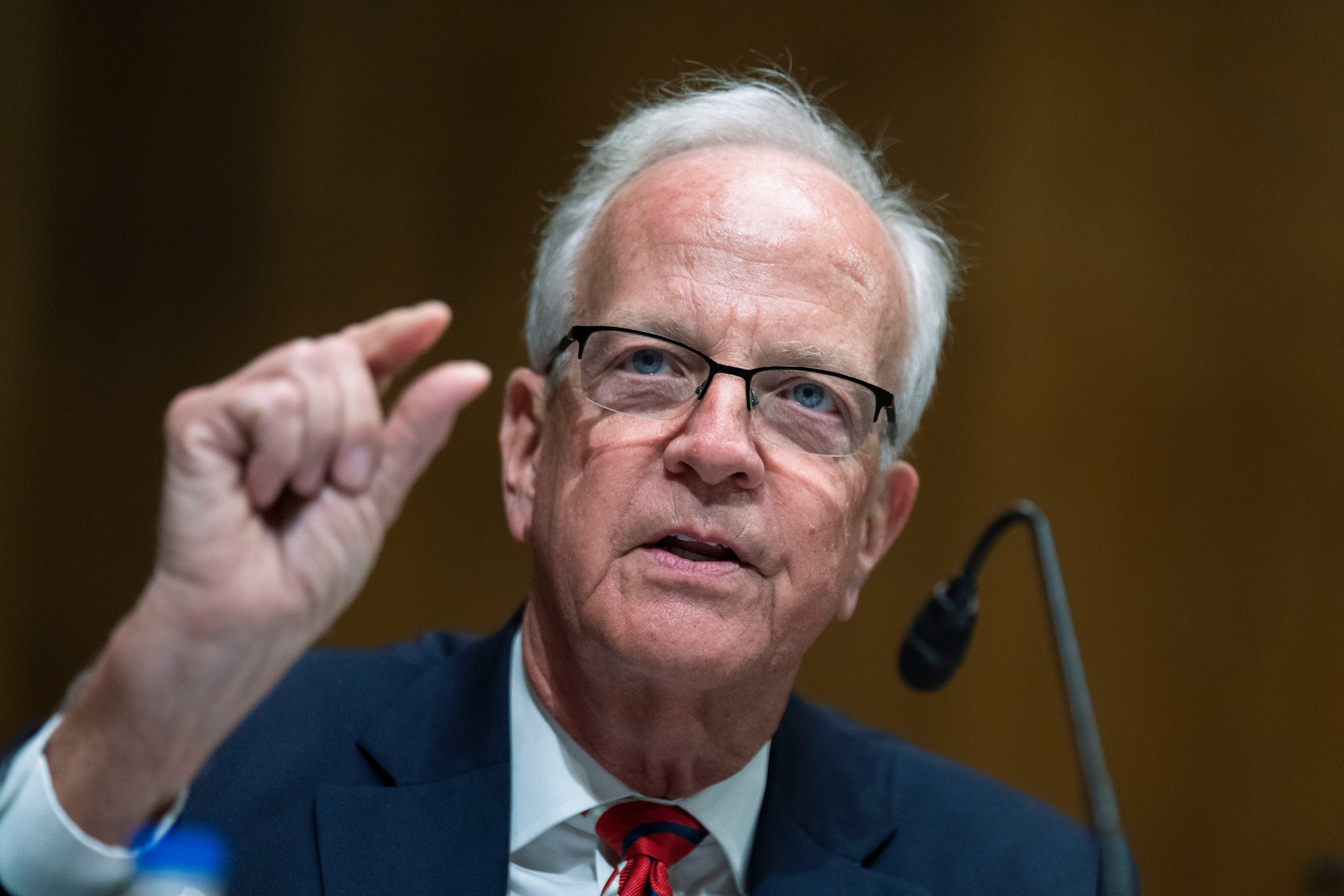

Reg Jones, a charter member of the senior executive service, is our resident expert on retirement and the federal government. From 1979 to '95, he served as an assistant director of the Office of Personnel Management handling recruiting and examining, white and blue collar pay, retirement, insurance and other issues. Opinions expressed are his own.