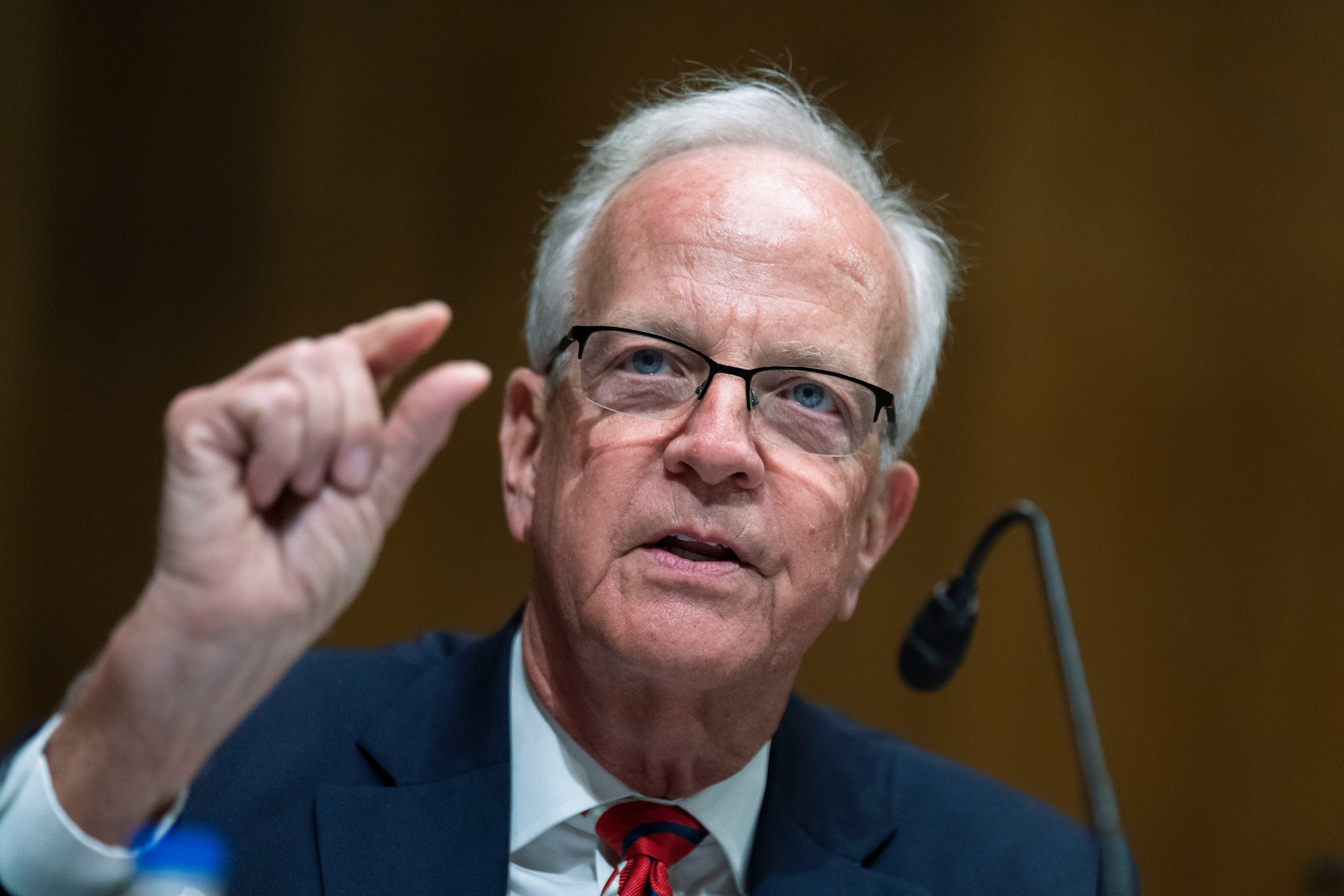

Comptroller General Gene Dodaro appeared before the House Oversight Committee on April 13 to outline ways the government could reduce duplication and lost revenue.

"While Congress and executive branch agencies have made progress toward addressing the actions GAO has identified, further steps are needed to fully address the remaining actions," Dodaro said in testimony.

"GAO estimates that tens of billions of additional dollars would be saved should Congress and executive branch agencies fully address actions that are currently partially addressed or not addressed, including the new actions GAO identified in 2016."

Related:Read the report.

The annual report identified 37 new areas, and 92 new actions, the federal government can visit to save money and clamp down on redundancies. Here are four areas the committee was keen to visit.

- BRAC is back

One way the GAO says the Department of Defense could see cost savings is by reducing the underutilized footprint of its military installations, which could mean the return of Defense Base Closure and Realignment, or BRAC.

Defense Chief Management Officer David Tillotson agreed with the GAO's assessment and said the DoD agrees that another round of reductions could be on the horizon.

"It is the department's decision that another round of BRAC would be appropriate," he said. "There's a large amount of space that is more industrial and involves bases that, at this point, are largely underutilized. We do believe there is excess capacity that can be reviewed, so we endorse another round of BRAC."

- Fixing the tax gap

GAO calculates that the IRS fails to collect $385 billion in tax revenue annually through overstated deductions, underpayments, tax errors and other issues.

The new report issued 13 new recommendations, noting that 63 percent of the recommendations made from 2011-2015 regarding the tax gap remain open.

Rep. David Palmer, R-Ala., cited past Tax Policy Center research that put the tax gap at 16 to 20 percent, which is a significant loss he said, when the government is running a deficit.

"If $3 trillion came into the IRS last year, that means $500 billion to $550 billion should've been collected," he said.

John Dalrymple, IRS Deputy Commissioner for Services and Enforcement, said the gap is caused by a litany of issues and trying to get the funds would mean a significant ramp-up of enforcement.

"One of the things that needs to be completely understood about the tax gap is that it is made up of a lot of different monies owed," he said. "If we were to go after every last cent of the tax gap, it would be an incredibly intrusive process."

The GAO recommended for 2016 that the IRS streamline its public referrals and increase efforts to combat identity theft. It also noted that four previous recommendations remain open.

- Tackling unobligated balances

One of the hotter topics of the hearing was unobligated balances, which are budget appropriations not yet committed to a budget item.

The GAO report suggested that the departments of Energy and State could save "tens and hundreds of millions of dollars" in funding by better managing their balances.

After Palmer noted the federal budget is projected to require $30 billion more in spending and a 3.5 percent cut in unobligated balances would cover the costs, Dodaro said that Congress would be better served by reducing the balances by agency to find savings.

"I don't believe it would be prudent to do an across-the-board reduction," he said. "I think you have to look at targeted areas and agencies. In some cases, it may make sense [to do the cuts], in other cases not, but in no case should it be in excess of what the needs are."

- Improper payments

The familiar refrain of the GAO's has been addressing the issue of improper payments. The 2016 report again recommended that the Centers for Medicare & Medicaid Services take steps to increase oversight to prevent excess payments to providers, following still open recommendations from 2011 and 2013 to develop better controls to combat unexplained rate increases.

Dodaro said that CMS had acted on instituting a number of GAO's recommendations, but some remained open, including in Medicaid.

"I'm very concerned that we have not had a good oversight over the managed care portion of Medicaid at the state level," he said. "CMS is in the process of instituting a process that would provide more audits of what's going on in the managed care portion of Medicaid."