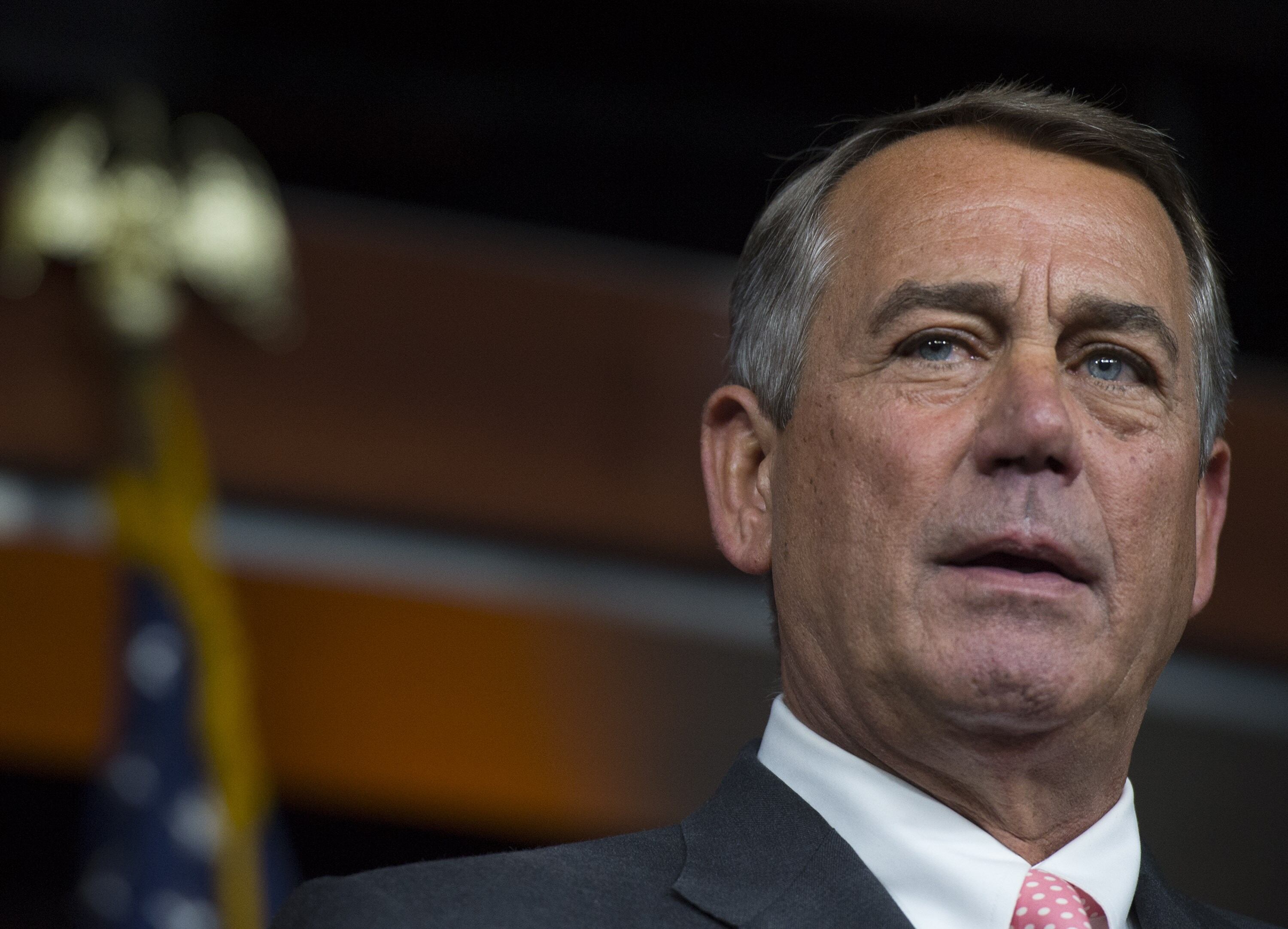

It appears that one of House Speaker John Boehner's final acts will avoid a December government shutdown, and also save 16 million Medicare beneficiaries from skyrocketing healthcare premiums.

For those not keeping track, that's the number of people who faced the prospect of 50 percent rate hikes, thanks to the ripple effect of the tagnant pricing of consumer goods. That particular scenario appears to have been squelched with a provision inserted into the budget deal Oct. 28, and signed into law Nov. 2 – but still with a rather costly caveat.

The roller coaster ride serves as a stark reminder of the influence that Capitol Hill has on federal employee nest eggs – for better or worse.

What's happening?

Federal employees started this open season with the ominous knowledge that, for the first time in five years, their health insurance premiums would rise — more than 6 percent on average.

For some, it was nearly far worse. Simply put, consumer price index numbers for the third quarter came in under the mark, translating to no cost of living adjustment (COLA) for 2016. For 30 percent of Medicare Part B beneficiaries — the group that receives funding for physician and outpatient hospital services from Social Security's Supplementary Medical Insurance Trust Fund, and which includes many federal retirees — that translated to health insurance premiums shooting up from $104.90 a month to $159.30.

That's a hike of more than 50 percent.

"That would be a big problem for a lot of people," Walt Francis, an economist and expert on the Federal Employees Health Benefits Program, said. "They face choices like, 'Do I drop Part B?' Or some older federal employees who are thinking of retiring next year may want to postpone their retirement so they can sign up for Part B a year later."

Federal employee unions and organizations decried the premiums, with some calling them "a double whammy" when coupled with the lack of a COLA for Medicare beneficiaries that do not currently receive Social Security. That faction was poised to be hardest hit by premium increases.

"This is about more than just money, it is about basic fairness," Richard Thissen, president of the National Active and Retired Federal Employees Association, said in a statement. "There is no reason why two people with the same income should pay different Medicare premiums based on whether the money is coming from a Social Security check or a checking account."

Boehner's spending bill makes up the difference with a loan from the Treasury to the Supplemental Medical Insurance Trust Fund. That loan will keep premiums down to $120 a month for the beneficiaries that faced inordinant increases. That said, those beneficiaries will foot the bill longer term via a monthly $3 repayment tacked on to the premiums. Higher income beneficiaries will pay more than $3, depending on their income bracket.

If there is no COLA increase for 2017, the new provision would apply again.

For the rest, a reality check

So, universally speaking, is a 6.4 percent premium hike in 2016 unreasonable? Not when compared to the creeping costs of health care marketwide, even if the modest 1.3 percent pay raise for active employees and no cost of living adjustment for retirees make the prospect far less palpable.

"Because of the recession, we've had four or five years of below-average increases in health care costs," Francis said. "We've kind of worked out of the recession, so health care costs have resumed their somewhat faster upward trend."

Initial data shows this year's FEHBP premium rates to be in line with costs increases in the private market — not unusually high or unusually low compared to everywhere else. Also important to note is the average 7.4 percent rate for enrollees announced by the Office of Personnel Management in September, which is spread across 252 health care plans. There could be options for federal employees looking to lower their costs.

"There are always much better deals than most people are in," Francis said. "There are potential savings in the range of several thousand dollars a year by plan choices they can make. So like every year, your plan may be going up more or less than average, but regardless you might want to at least think about the possibility that some other plan might fit you better."

The Self Plus One Effect

Factoring into the rate hike is a new feature of the FEHBP open season for 2016: the Self Plus One plan, which is designed for smaller family beneficiaries who want insurance that covers only two people.

The plan gives more flexibility to smaller households, which will typically pay a few percent less in premiums than the typical family plan. But the savings have to be made up somewhere, Francis said.

"Self Plus One carved out these couples and single parents with a kid from the larger group of families," he said. "To keep everything on an even keel, family premiums have gone up a few percent more than they would have gone up otherwise."

OPM estimates that beneficiaries with family coverage will pay an average of $19.61 more per pay period, depending on coverage, while Self Plus One beneficiaries are expected to pay an average of $192.71 every two weeks.

But as one federal executive said, while the Self Plus One rate under the Blue Cross and Blue Shield Standard Option is less than the broader family plan for 2016, it will cost $18 more per pay period than the family coverage last year.

"I am really put out and generally disgusted with the rollout of Self Plus One," said the executive, who was not authorized to speak to the media and therefore asked not to be named.

There are caps on costs. OPM's FEHB program carrier letter announcing the beginning of Self Plus One to insurance companies in March does say that "in no event can Self Plus One rates be higher than Self and Family rates." Furthermore, benefits that vary between enrollment type, such as catastrophic maximum, "should be for dollar amounts that are less than or equal to corresponding benefits in Self and Family enrollment," according to the letter.

In general, the changes to health care plans will impact beneficiaries in a zero-sum fashion, Francis said. "There's not net-plus here," he said. "The total revenues [of] each plan have to equal the costs of the people enrolled in the plan."